Thanks to the best investing apps in Canada, it has never been easier for Canadians to start their journey toward financial freedom.

Users can simply sign up, fund their accounts, and begin buying and selling stocks and ETFs within a few minutes.

To help new traders get started, the stock market analysts at Best Canadian Stocks have ranked and reviewed the top investing apps in Canada.

Read on to learn more about the best investing apps in Canada and what they have to offer.

How To Buy and Sell Stocks On The Best Investing Apps In Canada

Today, the best investing apps make it easy to buy Canadian stocks.

In four easy steps, residents can receive free cash to invest in the best stocks to buy right now in Canada.

At Questrade, new users can simply sign up, add funds, make a trade, and receive a $50 trade commission rebate to buy and sell the top stocks in Canada.

Check out our step-by-step guide on how to buy the best Canadian stocks right now.

- Click here to sign up for a Questrade account

- Fill out the required documents with accurate personal information

- Add funds to your Questrade account

- Receive a $50 trade commission rebate to invest in the best Canadian stocks

Ranking The Best Investing Apps in Canada

- Questrade — $50 in free trades for new non-registered accounts

- Wealthsimple — $10 in free cash added to your non-registered account

- Interactive Brokers – Earn up to 1.83% USD on idle cash balances

- CIBC Investor’s Edge – Free trades for investors aged 18-24

- Desjardians Online Brokerage – Free investment training and analytics tools

- BMO InvestorLine — New self-directed accounts can get up to $2,000 cash back

- TD Direct Investing — Trusted Canadian investing app for registered and non-registered accounts

- Scotia Trade — Trade the best Canadian ETFs with zero commission

- QTrade Direct Investing — Great investing app for Canadians aged 30 and under

- RBC Direct Investing — $50 in free trades, plus a terrific loyalty program

Top Canadian Stock Trading Apps Reviewed

For individual users, the best investing apps in Canada will differ based on their needs, values, and stock trading experience.

Some investing apps in Canada offer free trades and cash just for signing up while others, like Interactive Brokers, are known for providing more advanced traders with the tools and analytics necessary to navigate challenging market conditions.

According to our research, Questrade, Wealthsimple, and Interactive Brokers are among the best Canadian stock trading apps but there are several other platforms that might be suitable for your needs

Scroll down below to learn more about each of the stock trading apps available in Canada and what separates them from the competition.

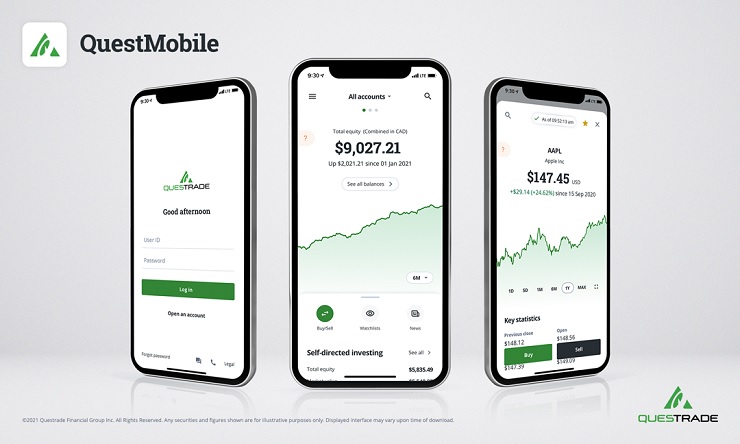

1. Questrade — $50 in free trades for when you open your first account

Questrade is one of the best investing apps operating in Canada. It was launched in 1999 and is mainly operated online. It’s good for both beginners and pros, and like any other big trading platform, Questrade enables you to trade almost all types of assets such as bonds, ETFs, mutual funds, Forex, and stocks.

Downloading the QuestTrade App will make your trading experience easier and faster. It also enables you to set a watchlist for your portfolio and stocks you are interested in. Nevertheless, it offers alerts, enabling you to take advantage of opportunities arising in the market. But that’s not all; if you are a new user, you stand a chance to get $50 in free trades.

Questrade account provides a cheap and safe way to invest. You only pay a portfolio management fee of 0.25% for investments below $1,000 and 0.2% beyond that. Funding your account is also easy with Questrade. By using Debit Visa Card or Interac, you can deposit a maximum of $3,500 per day to your account.

2. Wealthsimple — $10 in free cash added to your non-registered account

Wealthsimple is another great investing app that Canadians can use to trade stocks, ETFs, and cryptocurrencies.

Since no paperwork is required, setting up an account with Wealthsimple is quick and easy. Canadians are also not required to have a minimum balance in their account to make it active, making it great for traders that are new to investing.

The Wealthsimple app also makes it very simple to start trading securities. With it, you can instantly transfer money from one account to another.

Also, this app enables you to set real-time alerts and take advantage of stock movements as soon as they occur.

If you are looking for a platform that lets you deposit large deposits, Wealthsimple is the one! You can deposit up to $5,000 and $25,000 if you are a plus-member, making it one of the best stock trading apps in Canada

3. Interactive Brokers – Earn up to 1.83% USD on idle cash balances

Interactive Brokers is a platform that gives Canadian access to many markets and assets.

You can trade in up to 150 markets across 33 countries with an Interactive Brokers account. Canadians also don’t have to worry exchange fees, as this platform enables you to choose from 24 currencies. In addition to excellent educational and market analysis tools, Interactive Brokers offers low commission fees and competitive margin rates, which are approximately 66% lower than the industry average.

For Canadians looking for the best investing apps in Canada, you can count on the Interactive Brokers app, which enables you to set alerts and gives you access to over 200 free research reports and news.

This app also enables you to decide among over 100 different trading orders, making it an excellent option for more advanced investors. Besides, it also doubles up as a savings account, as members stand a chance to earn 1.83% on idle cash balances.

4. CIBC Investor’s Edge – Free trades for investors age 18-24

CIBC Investor’s Edge is a platform that enables Canadians to invest in various types of securities, such as mutual funds, stocks, options, ETFs, structured notes, etc.

With CIBC Investor’s Edge, Canadians can open registered accounts such as TFSA, RRSP, and RESP. The most interesting thing about the CIBC platform is its flat fee. It only charges $6.95 per equity trade. Members are also never required to maintain a minimum balance or minimum number of trades, making it a great choice for both passive investors and active traders.

The CIBC Mobile Wealth App also makes it easy to navigate through the various sections of the platform and also offers members access to a number of different video tutorials.

Like other popular investing apps in Canada, CIBC Investor’s Edge provides market alerts and research tools that aid your investment strategies.

The investing app is also great for young Canadians that want to start trading. Members aged 18 to 24 years will receive free trades when creating a new account.

5. Desjardians Online Brokerage – Free investment training and analytics tools

Desjardins Online Brokerage is a firm known for its discount services in Canada. Founded in 1982, it is operated by Desjardins Securities, a subsidiary of Desjardins Group.

Like some of the other top investing apps in Canada, the platform gives members access to most investing.

One advantage of trading with Desjardins Online Brokerage is that its fees and trading conditions, especially on mutual funds, are very competitive compared to other brokerage firms.

Whether you like being in control of your investment strategy or being guided in your investment journey, Desjardins Online Brokerage has options to suit investors of all experience levels.

Its Disnat app gives members access to two platforms: Disnat Classic and Disnat Direct.

Disnat Classic is mainly for beginners, while Disnat Direct is for active traders. If you are a beginner, you don’t have to worry about making mistakes since this platform will give you assess to free investment tutorials. Also, if you are between 18-30, you stand a chance to get five free trades.

6. BMO InvestorLine — New self-directed accounts can get up to $2,000 cash back

BMO InvestorLine is a Canadian investing app owned and managed by the Bank of Montreal Financial Group.

Founded in 1817, BMO is one of the oldest banks in Canada, making BMO InvestorLine one of the best stock trading apps in Canada.

The platform is quick and easy to use. Simply sign up, research the assets you want to invest in, and start trading. New created self-directed accounts also have a chance to get up to $2,000 in free trades.

BMO InvestorLine enables members to track their portfolio, allowing investors to better take advantage of upswings or downswings in the market. Like any other major investment platform, BMO InvestorLine enables you to open various accounts such as TFSA, RRSP, RRIF, RESP accounts and more.

For investors that want to make trades while on the go, the BMO InvestorLine app offers a full assortment of features that make it easy to buy and sell securities right from your mobile device. Available on both the Google Play and Apple App Store, the BMO InvestorLine app is one of the most secure investing apps in Canada.

The major disadvantage of BMO InvestorLine is that it charges commissions much higher than the average market commission fee. So, if you are pressed for money, you may want to use other platforms, like Questrade or Wealthsimple.

7. TD Direct Investing — Trusted Canadian Investing App For Registered and Non-Registered Accounts

TD Direct Investing platform was founded in 1984 and is considered one of the most popular investing apps in Canada.

By signing up to the TD Direct Investing platform, members get a chance to open and operate any of the registered accounts in Canada, such as RESP, TFSA, RRIF, LIRA, and more. This account also enables you to trade as many assets as possible such as equities, options, ETFs, fixed income assets, and term deposits.

TD Direct Investing platform is also known for its many platforms, including Web Broker, TD Mobile App, Advanced Dashboards and Thinkorswim. As a self-directed trader or investor, you can choose from these platforms depending on your expertise level.

New members can choose between $50 in free trades or investing $10,000 or less in a managed account free for one year.

TD Direct Investing platform, however, is among the platforms in Canada that charge a hefty transaction fee. For instance, you must pay $9.99 per trade if you are trading equities. Also, its account maintenance fee is not desirable as you have to pay a fee of $25 if your account balance falls below $15,000.

8. Scotia Trade — Trade The Best Canadian ETFs With Zero Commission

Scotia Trade is your platform if you want to trade ETFs without paying any commission.

Scotia Trade was launched in 2009 by Scotiabank, making it one of the most trusted investing apps in Canada.

The stock trading app gives members access to all registered and non-registered accounts in Canada. With the Scotia Trade platform, Canadians can open registered accounts such as TFSA, RRSP, RRIF, and RESP accounts. Members can also open non-registered accounts at Scotia Trade, including a Scotia iTrade Margin Account and Scotia iTrade Cash Account.

This platform is suitable for self-directed investors who want to trade ETFs, stocks, options, and more. It also has a stock rating tool embedded in its Scotia iTrade Mobile App, making it great for traders of all experience levels.

At Scotia Trade, new users are awarded 10 free equity trades when you invest $1,000 or more.

Like the TD Direct Investing platform, Scotia trade charges a large trading fee. Members have to pay $9.99 per equity trade. However, if you are an active trader, you can pay a reduced fee of $4.99 per equity trade. To qualify as an active trader, you must trade at least 150 trades each quarter, which amounts to about 50 trades per month.

Scotia Trade platform also charges an administrative fee depending on the type of account you own.

For example, if your open a registered account, you will be asked to pay an administrative fee of $100 per year when the balance goes below $25,000. On the other hand, if your account is a non-registered account, you will be forced to pay an administrative fee of $25 per quarter if the balance falls below $10,000.

Luckily, if you are below the age of 26 years, these fees are waived. However, you must monitor other fees, such as monthly statement fees, account transfer fees, etc.

9. QTrade Direct Investing — Great Investing App For Canadians Age 30 and Under

QTrade Direct Investing platform is a sub-division of Credential Qtrade Securities, owned by Aviso Wealth.

It is considered one of the best investing apps in Canada, having won many awards. By using the Qtrade App, which is compatible with Android and iOS devices, you can easily trade all types of assets.

The main issue with this platform is that it charges a very competitive commission fee. For instance, you pay $8.75 for each equity trade you make and that’s not all! You also pay other fees, such as account administration and statement fees.

The good news is that the stock trading app also gives commission discounts to active traders who make over 150 trades per month, and if you are new, you get at least 50 free trades.

Also, if you are 18-30 years old, the QTrade Direct Investing platform is $50 each month and gives members a $1 discount on stock and ETF trades. Besides, your quarterly account administration fee is voided.

10. RBC Direct Investing — $50 in Free Trades, Plus Terrific Loyalty Program

If you are a self-directed investor looking for a platform with a flat fee when trading stocks, ETFs, options, mutual funds, crypto, etc., RBC Direct Investing is for you.

Unlike some of the top investing apps in Canada, RBC Direct Investing charges $9.95 per trade, but there are also other fees, such as an account maintenance fee of $25 per quarter when the account balance gets below $15,000.

With RBC mobile app, you can track the performance of such trades. The interesting thing about RBC Direct Investing is that it awards points that you can convert into trades. It can also waive the maintenance fee under special circumstances, such as being six months old on the platform, among other things.

As a new client, you are awarded free trades of $50 in value or given a chance to invest $10,000 free for one year.