Investing in lithium stocks presents an exciting opportunity for investors to capitalize on the growing demand for lithium-ion batteries, which are crucial components in electric vehicles, grid storage systems, and various consumer electronics. In fact, the manufacturing of rechargeable batteries for these applications accounts for a staggering 80% of total global lithium demand.

As the world transitions towards cleaner energy sources and sustainable technologies, the demand for lithium is expected to soar, driving significant growth in the lithium market. The Canadian government even recently identified lithium as a crucial mineral and key material in the renewable energy transition. As a result, several Canadian lithium stocks could be on the rise in the future.

Below, we’ll uncover the best Canadian lithium stocks and why they are poised to meet the escalating demand for lithium in the electric vehicle and renewable energy sectors.

Key Highlights:

- Manufacturing of rechargeable batteries for electronics, electric vehicles, and grid storage represent 80% of total global lithium demand

- The Government of Canada has identified lithium as a key material in the renewable energy transition

- Lithium Americas Corp. & Neo Lithium Corp. rank among the best Canadian lithium stocks to buy in 2024

Are Lithium Stocks A Buy Right Now?

Lithium and EV stocks like Tesla have delivered huge gains for investors over the past few years.

Currently, the lithium market is experiencing significant growth due to the increasing demand for lithium-ion batteries used in electric vehicles and renewable energy storage systems. This demand surge has propelled lithium stocks to the forefront of many investors’ radars.

For Canadians with a long-term perspective and risk tolerance, carefully selected lithium stocks could present compelling investment opportunities.

Comparing The Top Lithium Stocks In Canada

| Company | Stock Symbol | Rating | Market Cap |

|---|---|---|---|

| Lithium Americas Corp. | LAC.TO | ⭐⭐⭐⭐⭐ | 1.187B |

| Lithium Royalty Corp. | LIRC.TO | ⭐⭐⭐⭐ | 411.501M |

| Standard Lithium Ltd. | SLI.V | ⭐⭐⭐⭐ | 303.52M |

| Sigma Lithium Corporation | SGML.V | ⭐⭐⭐⭐ | 2.351B |

| Frontier Lithium Inc. | FL.TO | ⭐⭐⭐⭐ | 268.6M |

| Avalon Advanced Materials Inc. | AVL.TO | ⭐⭐⭐ | 47.632M |

| Critical Elements Lithium Corporation | CRE.TO | ⭐⭐⭐ | 148.094M |

| American Lithium Corp. | LI.V | ⭐⭐⭐ | 221.096M |

| Li-FT Power Ltd. | LIFT.V | ⭐⭐⭐ | N/A |

| Power Metals Corp. | PWM.TO | ⭐⭐⭐ | 39.023M |

How To Buy The Best Canadian Lithium Stocks

In 2024, the best investing apps make it easy to buy lithium stocks and ETFs in Canada.

In just four easy steps, Canadians can receive free cash to invest in the best lithium stocks right now.

At Questrade, new users can simply sign up, add funds, make a trade, and receive a $50 trade commission rebate to buy the best lithium stocks in Canada.

Check out our step-by-step guide on how to buy lithium stocks in Canada.

- Click here to sign up for a Questrade account

- Fill out the required documents with accurate personal information

- Add funds to your Questrade account

- Receive a $50 trade commission rebate to invest in the best Canadian lithium stocks

Ranking The Best Lithium Stocks To Buy in Canada

In the quest for sustainable energy solutions, lithium has emerged as a critical element powering the transition towards clean transportation and renewable energy storage. As the demand for electric vehicles (EVs) and grid-scale batteries continues to soar, Canadian investors are turning their attention to lithium stocks as a lucrative opportunity in the emerging clean energy sector.

With a focus on sustainability, technological advancements, and strategic partnerships, these Canadian lithium stocks are poised to capitalize on the growing demand for lithium-ion batteries and solidify Canada’s position as a key player in the clean energy revolution.

- Lithium Americas Corp. (LAC.TO)

- Neo Lithium Corp. (NLC.TO)

- Standard Lithium Ltd. (SLI.TO)

- Sigma Lithium Corporation (SGML.V)

- Frontier Lithium Inc. (FL.V)

- Avalon Advanced Materials Inc. (AVL.TO)

- Critical Elements Lithium Corporation (CRE.TO)

- American Lithium Corp. (LI.TO)

- Li-FT Power Ltd. (LIFT.V)

- Power Metals Corp. (PWM.TO)

Analyzing The Best Canadian Lithium Stocks To Buy In March 2024

In the world of renewable energy, lithium stands as a cornerstone element, essential for powering electric vehicles and storing renewable energy. Known for its resource-rich landscape and commitment to sustainability, Canada has become a hub for lithium exploration and production. The Government of Canada has even identified lithium as a key material in the renewable energy transition.

Below, we’ll break down the key factors influencing the performance of the top Canadian lithium stocks, including their project portfolios, market capitalization, financial health, and growth prospects.

1. Lithium Americas Corp. (LAC.TO) — Expanding Lithium Production Amid Growing Demand

- Rating: ⭐⭐⭐⭐⭐

- 52 Week Range: 5.17 – 16.07

- Avg. Volume: 470,298

- Market Cap: 1.187B

- PE Ratio (TTM): N/A

- EPS (TTM): -0.10

- Earnings Date: Mar 29, 2024

One of the best Canadian energy stocks to buy in 2024, Lithium Americas Corp. is poised to capitalize on the increasing demand for lithium-ion batteries driven by the electric vehicle revolution and renewable energy storage solutions.

The company boasts a diverse portfolio of lithium projects, with its flagship asset being the Cauchari-Olaroz project in Argentina, a joint venture with Ganfeng Lithium, one of the world’s largest lithium producers. With its strategic location in the Lithium Triangle and favorable political support, the Cauchari-Olaroz project is primed for efficient production and long-term sustainability.

Additionally, Lithium Americas has a robust pipeline of projects, including the Thacker Pass project in Nevada, positioning itself to meet the growing demand for lithium in North America.

Founded in 2007, Lithium Americas Corp. gives Canadian investors exposure to the lithium industry and EV market, two sectors that appear poised for substantial future growth.

2. Lithium Royalty Corp. (LIRC.TO) — Leading Lithium Royalty & Streaming Company

- Rating: ⭐⭐⭐⭐

- 52 Week Range: 6.56 – 17.00

- Avg. Volume: 71,570

- Market Cap: 411.501M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.01

- Earnings Date: N/A

Founded in 2017, Lithium Royalty Corp. (LIRC.TO) occupies a strategic position in the global energy transition.

As a lithium-focused royalty company, it boasts a diversified portfolio of royalties on mineral properties worldwide, poised to support the electrification and decarbonization of the global economy. The company’s commitment to sustainability and its pivotal role in the battery supply chain for the transportation industry underscore its significance in the clean energy revolution.

With the rapid proliferation of electric vehicles (EVs), Lithium Royalty Corp.’s focus has rightly been on the battery supply chain. This strategic alignment ensures the company is well-positioned to capitalize on the up-and-coming demand in the EV market.

With a focus on sustainability, innovation, and strategic partnerships, the company is primed to deliver long-term value to shareholders while driving positive environmental impact.

3. Standard Lithium Ltd. (SLI.V) — Utilizing Innovative Extraction Technologies for Sustainable Lithium Supply

- Rating: ⭐⭐⭐⭐

- 52 Week Range: 1.5100 – 6.3800

- Avg. Volume: 145,863

- Market Cap: 303.52M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.28

- Earnings Date: May 11, 2024

Standard Lithium Ltd. is a leading lithium exploration and development company with a primary focus on unlocking the potential of unconventional lithium resources in North America. Established in 2017, Standard Lithium has quickly emerged as a key player in the lithium sector due to its innovative approach to lithium extraction and its strategic partnerships.

The company is known for its Lanxess South Arkansas lithium brine project, which leverages advanced extraction technologies to recover lithium from brine produced as a byproduct of bromine extraction operations. This unique approach allows Standard Lithium to access lithium resources that were previously overlooked, providing a sustainable and environmentally friendly solution for lithium production.

Standard Lithium has demonstrated significant progress at the Lanxess project, including successful pilot plant testing and resource delineation drilling, highlighting the project’s robust economics and potential for scalable production.

4. Sigma Lithium Corporation (SGML.V) — Exploring Promising Lithium Prospects with Significant Resource Potential

- Rating: ⭐⭐⭐⭐

- 52 Week Range: 14.03 – 57.57

- Avg. Volume: 29,956

- Market Cap: 2.351B

- PE Ratio (TTM): N/A

- EPS (TTM): -1.02

- Earnings Date: N/A

One of the best Canadian lithium stocks to buy right now, Sigma Lithium Corporation (SGML.V) is focused on developing high-quality lithium projects in Brazil. Founded in 2012, Sigma Lithium has rapidly emerged as a key player in the global lithium market, leveraging its extensive expertise and strategic assets to capitalize on the growing demand for lithium-ion batteries.

The company’s flagship asset is the Grota do Cirilo Lithium Project, located in the state of Minas Gerais, Brazil. Grota do Cirilo is recognized for its significant lithium resources and favorable geological characteristics, making it one of the highest-grade lithium deposits globally. Sigma Lithium has conducted extensive exploration and drilling programs at the project, resulting in the delineation of substantial lithium resources and reserves

5. Frontier Lithium Inc. (FL.TO) — Developing Large-Scale Lithium Deposits to Meet Global Demand

- Rating: ⭐⭐⭐⭐

- 52 Week Range: 0.4100 – 2.6400

- Avg. Volume: 231,000

- Market Cap: 268.6M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.14

- Earnings Date: Feb 26, 2024

One of the best Canadian mining stocks, Frontier Lithium Inc. is known for advancing its high-quality lithium projects, with a primary focus on the PAK Lithium Project located in northwestern Ontario, Canada. Founded in 2011, Frontier Lithium has emerged as a prominent player in the lithium sector, driven by its commitment to innovation, sustainability, and responsible resource development.

The PAK Lithium Project is distinguished by its significant lithium resources, including both spodumene-bearing pegmatites and lithium-bearing claystone deposits. These resources offer Frontier Lithium a unique advantage, allowing the company to explore multiple extraction methods and maximize its potential for lithium production.

Frontier Lithium is also actively involved in research and development initiatives aimed at advancing lithium extraction technologies and improving environmental performance throughout the lithium supply chain. This commitment to innovation aligns with the company’s vision of becoming a leading supplier of responsibly sourced lithium products for the growing electric vehicle and energy storage markets.

6. Avalon Advanced Materials Inc. (AVL.TO) — Leveraging Sustainable Practices in Lithium Extraction and Production

- Rating: ⭐⭐⭐

- 52 Week Range: 0.0800 – 0.1800

- Avg. Volume: 128,941

- Market Cap: 47.632M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.01

- Earnings Date: Apr 11, 2024

One of the top Canadian penny stocks, Avalon Advanced Materials Inc. is focused on advancing its diversified portfolio of critical mineral projects. Founded in 1991, Avalon has built a strong reputation for its expertise in rare metals, specialty minerals, and advanced materials, making it a prominent player in the global materials industry.

The company’s flagship project is the Nechalacho Rare Earth Elements (REE) Project located in the Northwest Territories, Canada. Nechalacho is one of the largest undeveloped REE deposits outside of China, with significant potential to supply critical REEs essential for various high-tech applications, including electronics, renewable energy technologies, and electric vehicles.

In addition to the Nechalacho Project, Avalon holds interests in other strategic mineral projects, including lithium, tantalum, tin, and indium properties. These projects are strategically positioned to capitalize on the growing demand for critical minerals driven by technological advancements and the transition to clean energy.

7. Critical Elements Lithium Corporation (CRE.TO) — Focused on Developing High-Grade Lithium Assets for Clean Energy Solutions

- Rating: ⭐⭐⭐

- 52 Week Range: 0.5500 – 2.9000

- Avg. Volume: 275,928

- Market Cap: 148.094M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.02

- Earnings Date: Jan 29, 2024

Critical Elements Lithium Corporation is a Canadian-based mineral exploration company focused on advancing its strategic lithium projects in Quebec, Canada. Established in 2006, Critical Elements has rapidly gained recognition for its high-quality lithium assets and its commitment to sustainable resource development.

Critical Elements has strategically positioned itself with its flagship Rose Lithium-Tantalum Project, located in the James Bay region of Quebec. The Rose Project is one of North America’s most promising lithium projects, boasting significant lithium resources and favorable metallurgical characteristics. Additionally, the project benefits from its proximity to infrastructure, including road access and nearby hydroelectric power, facilitating future development and production.

Overall, Critical Elements is well-aligned with the global shift towards sustainable energy solutions, particularly in the electric vehicle and renewable energy sectors.

8. American Lithium Corp. (LI.V) — Developing Lithium Projects in Strategic Locations for Global Markets

- Rating: ⭐⭐⭐

- 52 Week Range: 0.9000 – 3.9400

- Avg. Volume: 254,403

- Market Cap: 221.096M

- PE Ratio (TTM): N/A

- EPS (TTM): -0.19

- Earnings Date: May 27, 2024

American Lithium Corp. is a leading lithium exploration and development company headquartered in Vancouver, Canada. Established in 2018, the company is known for its TLC Lithium Project.

Located in Nevada, USA, it is recognized as one of the largest lithium-rich claystone deposits in the world. With shallow depth and near-surface mineralization, TLC boasts significant lithium resources, positioning it as a key asset in the company’s portfolio.

Beyond the TLC project, American Lithium holds exploration properties across Nevada and Alberta, Canada, augmenting its resource base and growth potential.

With its robust portfolio of lithium assets, technical prowess, and commitment to sustainability, the company presents an attractive investment opportunity for those seeking exposure to the rapidly expanding lithium market.

9. Li-FT Power Ltd. (LIFT.V) — Advancing Lithium Projects with a Focus on Sustainability and Innovation

- Rating: ⭐⭐⭐

- 52 Week Range: 4.0900 – 10.3700

- Avg. Volume: 46,990

- Market Cap: N/A

- PE Ratio (TTM): N/A

- EPS (TTM): N/A

- Earnings Date: N/A

One of the best Canadian stocks in the lithium sector, Li-FT Power Ltd. (LIFT.V) is dedicated to consolidating and advancing hard rock lithium projects exclusively within Canada. Founded in 2021, the company swiftly transitioned to the public market in early 2023, listing on the Canadian Securities Exchange under the ticker LIFT.

At the forefront of Li-FT Power’s endeavors is an impressive exploration portfolio comprising world-class hard-rock lithium potential. Among its standout projects is the Yellowknife Lithium Project, boasting a portfolio of 13 spodumene pegmatites discovered in the 1950s, complemented by excellent existing infrastructure.

Further bolstering its position in the lithium sector, Li-FT Power holds 2,300 km2 of ground in the James Bay region of Quebec, strategically surrounding the Whabouchi Lithium deposit, a significant lithium resource. Additionally, the company’s Cali property in the Northwest Territories features a promising 60m wide spodumene pegmatite, outcropping over 500m of strike length.

10. Power Metals Corp. (PWM.TO) — Exploring Lithium Resources in Emerging Markets to Meet Future Demand

- Rating: ⭐⭐⭐

- 52 Week Range: 0.2100 – 0.5900

- Avg. Volume: 130,363

- Market Cap: 39.023M

- PE Ratio (TTM): N/A

- EPS (TTM): N/A

- Earnings Date: N/A

Founded in 2016, Power Metals has quickly gained recognition for its strategic portfolio of projects, particularly in the lithium-rich region of Ontario, Canada.

The company’s flagship asset is the Case Lake Lithium Property, located in northeastern Ontario. This property boasts significant lithium resources and favorable geological characteristics, making it a promising asset for Power Metals.

Power Metals is committed to responsible resource development and environmental stewardship, engaging with local communities and regulatory authorities to ensure sustainable operations.

With the increasing demand for lithium-ion batteries, particularly in electric vehicles and renewable energy storage systems, Power Metals Corp. is well-positioned to capitalize on this trend and deliver significant value to its shareholders.

What Are Lithium Stocks?

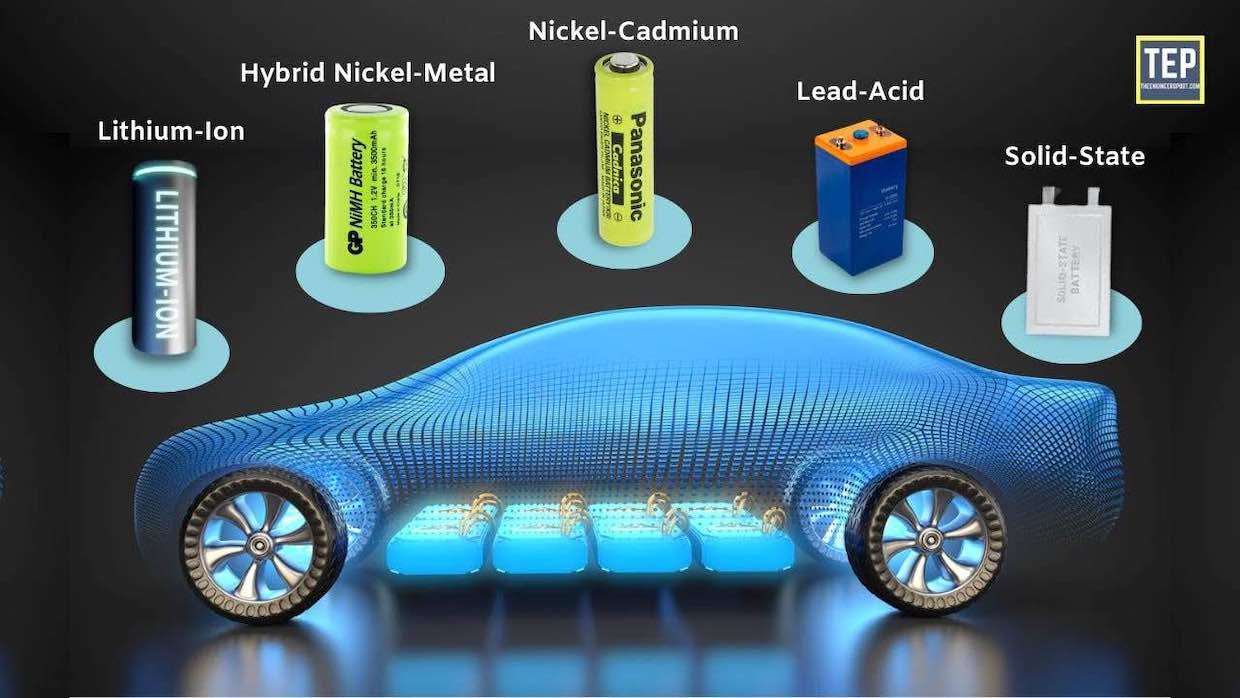

Lithium stocks are shares of companies involved in the exploration, development, production, or supply of lithium, a crucial component in batteries used in electric vehicles (EVs), consumer electronics, and energy storage systems. These stocks can include mining companies that extract lithium from the earth’s crust, as well as companies involved in lithium refining, battery manufacturing, and technology development.

Investing in lithium stocks allows investors to capitalize on the growing demand for lithium-ion batteries driven by the shift toward electric vehicles and renewable energy sources. As the world moves toward cleaner energy alternatives, lithium stocks are gaining attention for their potential to benefit from the ongoing electrification trend.

Unlike the top gold stocks in Canada, many lithium companies don’t pay dividends to Canadian investors. Instead, they offer the potential for explosive capital gains in an industry expected to grow by 22x by 2050.

Types of Lithium Stocks

From mining companies at the forefront of lithium extraction to innovative technology providers shaping the future of energy storage, the lithium sector offers a spectrum of investment avenues. These include lithium mining companies, battery manufacturers, lithium producers, and technology and materials providers,

In this section, we’ll explore these types of lithium stocks in detail, providing insights into their roles within the lithium industry and their potential for investment returns.

Lithium Mining Companies

These companies are engaged in the exploration, development, and extraction of lithium from lithium-rich deposits. They operate mines and processing facilities to produce lithium carbonate, lithium hydroxide, and other lithium compounds.

Examples:

- Albemarle Corporation (ALB)

- Livent Corporation (LTHM)

Battery Manufacturers

Some companies are involved in the manufacturing of lithium-ion batteries used in electric vehicles, consumer electronics, and energy storage systems. These companies may produce batteries for various applications and may also be involved in battery recycling and research and development of battery technology.

Examples:

- Tesla, Inc. (TSLA)

- Panasonic Corporation (PCRFY)

Lithium Producers

These companies primarily focus on refining and processing raw lithium materials into battery-grade lithium compounds. They play a crucial role in supplying high-quality lithium products to battery manufacturers and other end-users.

Examples:

- Livent Corporation (LTHM)

- Orocobre Limited (ORE.TO)

Technology and Materials Providers

Companies involved in the development of lithium extraction technologies, battery materials, and energy storage solutions also offer investment opportunities in the lithium sector. These companies contribute to innovation and advancements in lithium-related technologies.

- Lithium Americas Corp. (LAC.TO)

- Novonix Limited (NVX.AX)

Canadian Lithium ETFs?

Canadian ETFs focused on the lithium sector provide investors with diversified exposure to a basket of lithium-related stocks. Investing in Canadian lithium ETFs can offer a convenient way to gain exposure to the overall performance of the lithium industry.

Investing in Canadian Lithium ETFs can offer exposure to the growing demand for lithium, a crucial component in batteries used for electric vehicles (EVs), renewable energy storage, and consumer electronics. As the shift towards clean energy and electric transportation accelerates, lithium ETFs can provide investors with diversified exposure to companies involved in lithium mining, production, and battery technology.

Investing in Canadian Lithium ETFs can offer several advantages:

- Diversification: ETFs typically hold a basket of lithium-related stocks, providing investors with exposure to various companies across the lithium supply chain.

- Convenience: Investors can gain exposure to the lithium sector without the need to select individual stocks, saving time and effort.

- Risk Management: ETFs spread risk across multiple companies, reducing the impact of adverse events affecting any single company.

- Growth Potential: With demand for lithium increasing, driven by the EV and renewable energy sectors, lithium ETFs may offer the potential for capital appreciation.

Examples of Canadian Lithium ETFs

- Global X Lithium & Battery Tech ETF (LIT.TO)

- Horizons Global Lithium Producers Index ETF (HLIT.TO)

- Evolve Lithium & Battery Tech ETF (LITH.TO)

Why Buy Lithium Stocks In 2024

Overall, investing in lithium stocks in 2024 offers exposure to a rapidly growing market driven by the global transition towards clean energy and sustainable transportation. With favorable industry dynamics and strong growth prospects, lithium stocks present an attractive investment opportunity for investors seeking exposure to the burgeoning lithium-ion battery market.

Here are a few reasons to consider investing in Canadian lithium stocks in 2024.

- Electric Vehicle (EV) Adoption: The global push towards electrification, particularly in the automotive industry, continues to drive demand for lithium-ion batteries. As major automakers ramp up production of electric vehicles to meet regulatory targets and consumer demand for sustainable transportation grows, the demand for lithium, a key component in EV batteries, is expected to soar.

- Renewable Energy Storage: Lithium-ion batteries also play a critical role in storing renewable energy generated from sources like solar and wind power. As countries strive to reduce reliance on fossil fuels and transition towards renewable energy, the need for efficient energy storage solutions, including lithium batteries, is likely to increase.

- Infrastructure Spending: Government initiatives aimed at building sustainable infrastructure and reducing carbon emissions are expected to further boost demand for lithium. Stimulus packages and infrastructure investments focused on EV charging stations, grid storage projects, and renewable energy installations could drive significant demand for lithium products.

- Technological Advancements: Ongoing research and development efforts in battery technology are continuously improving the performance and efficiency of lithium-ion batteries. Innovations such as solid-state batteries and advancements in lithium extraction techniques have the potential to enhance the competitiveness of lithium-based energy storage solutions.

- Supply Constraints: Despite increasing demand, lithium supply remains constrained, with challenges related to mine expansions, permitting delays, and environmental concerns. This supply-demand imbalance could lead to upward pressure on lithium prices, benefiting companies involved in lithium exploration, mining, and production.

What Are The Best Canadian Lithium Stocks To Buy Right Now?

Investors eyeing Canadian lithium stocks for potential growth opportunities may consider prominent players like Lithium Americas Corp (LAC.TO), Lithium Royalty Corp. (LIRC.TO), and Standard Lithium Ltd (SLI.V).

These companies are actively involved in lithium exploration, development, and production, positioning themselves to capitalize on the rising demand for lithium-ion batteries driven by the electric vehicle revolution and renewable energy storage. With promising projects and a focus on meeting the growing demand for lithium products, these stocks offer potential exposure to the booming lithium market.