Known for commission-free trading, Wealthsimple has become known as one of the best investing apps for buying Canadian stocks. The Canadian stock trading platform has also introduced new features, including cryptocurrency investing, options trading, and more. In this article, we’ll go over our overall rating for Wealthsimple, highlight the pros and cons of the Wealthsimple app, and walk new users from Canada through how to sign up for the Wealthsimple app.

How To Buy Stocks on Wealthsimple For Free

- Click here to sign up for a non-registered Wealthsimple account

- Add funds to Wealthsimple Trade

- Make a commission-free trade of at least $100

- Receive $10 in free cash to invest in the best Canadian stocks

Wealthsimple Review ⭐⭐⭐⭐⭐

Known for commission-free trading, Wealthsimple is a great option for Canadians who are looking for a user-friendly, low-cost way to invest their money. Whether you’re a beginner or an experienced investor, Wealthsimple has the tools and features you need to grow your wealth over time.

One of the best features of the Wealthsimple app is its automated investing tools. You can set up a personalized investment portfolio based on your risk tolerance and investment goals, and the app will automatically rebalance your portfolio as needed to maintain your desired asset allocation.

The app also includes helpful educational resources to help you learn about investing and personal finance. Wealthsimple’s customer support team is available through the app and offers fast, friendly assistance when you need it.

Overall, Wealthsimple’s app is a top-notch investment platform that offers a range of powerful features to help you grow your wealth over time. Whether you’re a seasoned investor or just starting out, the app is a great way to manage your finances and achieve your financial goals.

|

Wealthsimple Features |

Rating |

|

💵 Pricing |

⭐⭐⭐⭐⭐ |

| 💻 Customer Service |

⭐⭐⭐ |

|

📈 User Experience |

⭐⭐⭐⭐ |

| 📱 Mobile App |

⭐⭐⭐⭐ |

|

🔏 Online Security |

⭐⭐⭐⭐⭐ |

| 📊 Overall Value |

⭐⭐⭐⭐⭐ |

Wealthsimple Highlights

One of the standout features of the Wealthsimple app is its integration with the Wealthsimple Wealth Management platform.

Wealthsimple users can users manage their accounts, including their registered and non-registered investment accounts, including TFSA, RRSP, and other tax-advantaged accounts.

This makes it easy for users to track and manage their entire investment portfolio in one place.

Available for both iOS and Android devices, the Wealthsimple app can be downloaded from the App Store or Google Play.

It is also compatible with Apple Watch and Android Wear, allowing users to access key information and place trades from their smartwatch.

|

Wealthsimple Trade |

Wealthsimple Crypto | Wealthsimple Tax | |

|

Best for |

Beginners | Beginner to Intermediate | Beginners |

| Products | Stocks, ETFs, mutual funds, options | Over 50 Cryptocurrencies |

Free Tax Software |

|

Web Platform |

✅ | ✅ | ✅ |

| Mobile App | ✅ | ✅ |

✅ |

Does Wealthsimple Offer Free Trades for Canadian Stocks?

Wealthsimple offers commission-free trades for the best Canadian stocks and ETFs. This means that you won’t be charged a commission when you buy or sell these securities on the Wealthsimple platform.

However, it’s important to note that there are other fees associated with using Wealthsimple, including management fees for the Wealthsimple Invest service, as well as fees for foreign exchange transactions, account transfers, and other services.

It’s also important to consider that while commission-free trades can be appealing, they are not the only factor to consider when choosing an investment platform. It’s important to consider other factors such as investment options, fees, account types, and customer support before making a decision.

What Is Wealthsimple?

Wealthsimple is a Canadian financial technology company that offers a suite of financial products and services, including online investing, savings accounts, and cryptocurrency trading. It was founded in 2014 and has since expanded to the United States and the United Kingdom.

Wealthsimple’s primary service is online investing, which allows users to create a customized investment portfolio based on their risk tolerance and investment goals. The platform offers a range of investment products, including exchange-traded funds (ETFs), options trading, socially responsible investment options, and Halal investment options for Muslim investors.

Wealthsimple also offers a high-interest savings account called Wealthsimple Save, which is insured by the Canada Deposit Insurance Corporation (CDIC) and offers a competitive interest rate. Additionally, the company launched a cryptocurrency trading platform called Wealthsimple Crypto, which allows users to buy and sell Bitcoin and Ethereum.

Wealthsimple Trade

Wealthsimple Trade is an online investing platform that allows you to buy and sell stocks, ETFs, and cryptocurrencies with no commission fees. It’s a great way to invest your money if you’re just starting out and don’t want to pay high fees to a traditional broker.

Using Wealthsimple Trade is really easy. First, you’ll need to sign up for an account and complete the registration process. Once you’re all set up, you can transfer money into your account and start buying stocks or other investments.

Wealthsimple Trade has a user-friendly app that you can download to your phone, so you can easily check your portfolio and make trades on the go. You can also set up automatic deposits to invest regularly without having to think about it.

One thing to keep in mind is that Wealthsimple Trade doesn’t offer as many investment options as some other brokers. However, they do offer a wide range of ETFs and a selection of individual stocks and cryptocurrencies to choose from.

Overall, Wealthsimple Trade is a great option for beginners and investors that want a simple, low-cost way to build their wealth. It’s important to remember that investing always carries some risk, but Wealthsimple Trade makes it easy to get started and build a diversified portfolio over time.

Types of Wealthsimple Trade Accounts

Wealthsimple offers a variety of account types to suit different investment goals and risk profiles.

Whether you are saving for retirement, your child’s education, or your business’s future, Wealthsimple has an account that can help you reach your goals.

Here is a breakdown of the different account types available. Click to jump to an account type.

Registered Retirement Savings Plan (RRSP)

An RRSP is a type of investment account that allows Canadians to save for retirement while enjoying tax benefits. Contributions to an RRSP are tax-deductible, meaning you can deduct the amount of your contribution from your income for tax purposes. Wealthsimple offers both individual and group RRSPs.

Spousal RRSP

A Spousal RRSP is similar to a regular RRSP, but the account is in your spouse’s name. This can be beneficial if one spouse earns a higher income than the other, as it allows the higher-earning spouse to contribute to the account and receive the tax benefits, while the lower-earning spouse can withdraw the funds in retirement and pay a lower tax rate.

Tax-Free Savings Account (TFSA)

A TFSA is a type of investment account that allows Canadians to save and invest without paying tax on the growth or withdrawals. TFSA contributions are not tax-deductible, but any money you earn on your investments is tax-free. Wealthsimple offers both individual and group TFSAs.

Registered Education Savings Plan (RESP)

An RESP is a type of investment account that allows Canadians to save for their child’s education. Contributions to an RESP are not tax-deductible, but any money earned on the investments is tax-free as long as it is used for educational purposes. Wealthsimple offers individual RESPs.

Locked-In Retirement Account (LIRA)

A LIRA is a type of retirement account that is created when you transfer funds from a pension plan. The funds in a LIRA are “locked-in,” meaning you cannot withdraw them until you reach retirement age. Wealthsimple offers both individual and group LIRAs.

Business Invest

This is a type of investment account designed for small business owners who want to invest their company’s excess cash. Business Invest accounts are managed by Wealthsimple’s team of investment professionals, and the platform offers a range of investment options to suit different risk profiles.

Business Save

This is a high-interest savings account designed for small business owners who want to save their company’s excess cash. Business Save accounts offer a competitive interest rate and no minimum balance requirements.

First-Time Home Savings Account

An FHSA, or First-time Home Buyer Savings Account, is a special type of savings account that is available in some provinces in Canada, including British Columbia, Saskatchewan, and Ontario. The purpose of an FHSA is to help first-time home buyers save for a down payment on a home.

Wealthsimple Products

Wealthsimple has several different products for Canadian investors. Members can choose from managed account services, self-directed trading accounts, crypto accounts, and more.

Below, we’ll explore the different accounts available at Wealthsimple, their features, and their advantages. Click to jump to a Wealthsimple product.

- Wealthsimple Invest

- Weathsimple Trade

- Wealthsimple Crypto

- Wealthsimple Cash

- Wealthsimple Smart Savings Account

Wealthsimple Invest Account

Wealthsimple Invest is the flagship account of Wealthsimple, and it’s designed to make investing easy and accessible for everyone. With this account, you can choose from a range of diversified portfolios that are tailored to your investment goals and risk tolerance level.

The portfolios are managed by a team of experts, who use a mix of low-cost ETFs to achieve diversification and balance.

Check out some of the features and advantages of starting a Wealthsimple Invest account below.

Features:

- No account minimums

- Automatic rebalancing

- Tax-loss harvesting

- Socially responsible investing options

Advantages:

- Low fees

- Easy to use

- Tailored portfolios

- Professional management

Wealthsimple Trade Account

Wealthsimple Trade is a commission-free trading platform that allows you to buy and sell stocks and ETFs. With this account, you can trade on major North American exchanges, including the NYSE, NASDAQ, and TSX.

Check out some of the features and advantages of starting a Wealthsimple Trade account below.

Features:

- Commission-free trading

- User-friendly interface

- Real-time market data

- Easy funding and withdrawals

Advantages:

- Low fees

- User-friendly interface

- Commission-free trading

Wealthsimple Crypto Account

Wealthsimple Crypto is an account that allows you to buy and sell cryptocurrencies, including Bitcoin and Ethereum. With this account, you can invest in cryptocurrencies without needing to understand the complexities of blockchain technology. With commission-free trades and low standard fees, Wealthsimple Crypto is simple, secure, and easy to use.

Check out some of the features and advantages of starting a Wealthsimple Crypto account below.

Features:

- Easy to use

- Low fees

- Secure platform

- Instant settlement

Advantages:

- Easy access to cryptocurrencies

- Low fees

- Secure platform

Wealthsimple Cash Account

Wealthsimple Cash is a hybrid account that combines the features of a checking account and a savings account. With this account, you can deposit and withdraw money, pay bills, and earn interest on your balance. The account comes with a Visa debit card, which you can use to make purchases and withdraw cash from ATMs.

Check out some of the features and advantages of starting a Wealthsimple Cash account below.

Features:

- High-interest savings account

- No account fees

- Unlimited free transactions

- Visa debit card

Advantages:

- High-interest savings account

- No fees

- Easy access to funds

Wealthsimple Smart Savings Account

Wealthsimple Smart Savings is a high-interest savings account that automatically adjusts your interest rate to give you the best rate available. With this account, you can earn a competitive interest rate on your savings, without needing to shop around for the best rates.

Check out some of the features and advantages of starting a Wealthsimple Smart Savings account below.

Features:

- Competitive interest rates

- No account fees

- Automatic interest rate adjustment

- Unlimited free transactions

Advantages:

- Competitive interest rates

- No fees

- Automatic interest rate adjustment

In conclusion, Wealthsimple offers a range of accounts that cater to different investment goals and risk tolerance levels. Whether you’re a beginner investor or an experienced trader, there’s an account that can help you achieve your financial goals. With low fees, user-friendly interfaces, and professional management, Wealthsimple is a great option for anyone looking to invest in the stock market or cryptocurrencies, save for a rainy day, or simply earn a competitive interest rate on their savings.

Wealthsimple Crypto

Wealthsimple Crypto is an online platform that allows you to buy and sell cryptocurrencies, like Bitcoin and Ethereum. It’s a great option if you’re interested in investing in cryptocurrencies and want to do it in a simple and convenient way.

Using Wealthsimple Crypto is really easy. First, you’ll need to sign up for an account and complete the registration process. Once you’re all set up, you can transfer money into your account and start buying cryptocurrencies.

Wealthsimple Crypto has a user-friendly app that you can download to your phone, so you can easily check your portfolio and make trades on the go. The platform is also very secure, with multiple layers of encryption to protect your account and your investments.

While Wealthsimple Crypto is technically commission-free, there is a fee for buying and selling crypto on the platform. Wealthsimple Crypto charges between a 1.5-2.0 percent fee for every cryptocurrency transaction, which is applied to the spread on the bid and ask prices when buying or selling.

For small buyers and beginners that are just starting to add to their cryptocurrency holdings, Wealthsimple Crypto fees won’t make much of a difference. However, for more experienced traders and whales, the Wealthsimple Crypto fees could become exorbitant over time.

One thing to keep in mind is that cryptocurrencies are very volatile and can fluctuate in value rapidly. This means that investing in cryptocurrencies can be risky, and it’s important to do your research and invest wisely.

All in all, Wealthsimple Crypto is a great option if you’re interested in investing in cryptocurrencies and want a simple, low-cost way to do it. However, it’s important to remember that investing in cryptocurrencies carries some risk, and you should always invest responsibly and with caution.

Which Cryptocurrencies Can You Buy On Wealthsimple?

Wealthsimple offers over 50 cryptocurrencies available for commission-free trading.

At Wealthsimple, members can trade Bitcoin, Ethereum, Dogecoin, Litecoin, Solana, and more. The platform even offers several other tokens, including ApeCoin, Axie Infinity, Decentraland, Sandbox, and more.

Here are the coins available for trade at Wealthsimple Crypto:

- 0x (ZRX)

- 1 inch (1INCH)

- Aave (AAVE)

- ApeCoin (APE)

- Amp (AMP)

- Ankr (ANKR)

- Avalanche (AVAX)

- Axie Infinity (AXS)

- Balancer (BAL)

- Bancor (BNT)

- Band (BAND)

- Basic Attention Token (BAT)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Cartesi (CTSI)

- Celo (CELO)

- Chainlink (LINK)

- Chiliz (CHZ)

- Chromia (CHR)

- Compound (COMP)

- Cosmos (ATOM)

- COTI (COTI)

- Curve (CRV)

- Dai (DAI)

- Decentraland (MANA)

- Dogecoin (DOGE)

- dYdX (DYDX)

- Enjin (ENJ)

- Ethereum (ETH)

- Fantom (FTM)

- Filecoin (FIL)

- Gala (GALA)

- The Graph (GRT)

- Hedera (HBAR)

- Kyber Network (KNC)

- Litecoin (LTC)

- Loopring (LRC)

- Maker (MKR)

- NEAR Protocol (NEAR)

- Pax Gold (PAXG)

- Polkadot (DOT)

- Polygon (MATIC)

- Quant (QNT)

- Ren (REN)

- Sandbox (SAND)

- Shiba Inu (SHIB)

- Skale (SKL)

- Solana (SOL)

- Stellar (XLM)

- Storj (STORJ)

- SushiSwap (SUSHI)

- Synthetix (SNX)

- Tezos (XTZ)

- Uma (UMA)

- Uniswap (UNI)

- USD Coin (USDC)

- Yearn Finance (YFI)

Wealthsimple Crypto Staking

Wealthsimple has been criticized in the past for not offering as many options as other crypto trading platforms but the company has taken a major leap forward over the past year.

At Wealthsimple Crypto, members can stake their Ethereum and Solana and earn up to 4.5 percent. That means you can save money on fees and earn rewards on your crypto. Members can stake their coins in just a couple of taps and the rewards are automatically deposited in their accounts.

With more coins expected to be supported soon, there are plenty of reasons to begin staking at Wealthsimple.

What Is Staking?

Staking allows Wealthsimple members to earn passive income for holding certain cryptocurrencies.

This is a great way to earn more crypto without buying or selling your holdings. Instead, staking lets you earn passive rewards on your crypto by contributing to the Proof of Stake (POS) network of a particular cryptocurrency.

When you stake your crypto, you help the underlying blockchain of that asset become more secure and efficient. In exchange, you get rewarded with more assets from the network.

Currently, Wealthsimple offers the following Annual percentage yield (APY) on ETH and SOL:

• Ethereum (ETH) – 3.3%

• Solana (SOL) – 4%

Wealthsimple Crypto Fees

Unlike with other cryptocurrency trading platforms, there are no hidden fees at Wealthsimple.

Just like when you’re buying the best Canadian penny stocks, Wealthsimple makes it easy to buy your favorite cryptocurrencies, commission-free. Wealthsimple does not charge commission on trades, any fees to deposit, or any withdrawal fees.

Instead, Wealthsimple Crypto charges a straightforward 1.5–2 percent operational fee per transaction. Transaction fees include the cost of liquidity providers, operational fees, and safe coin storage.

Wealthsimple Tax

Wealthsimple Tax is a simple and easy-to-use tax preparation software that can save you time and help you file your taxes accurately. It’s a great option if you want to avoid the hassle of doing your taxes manually or if you’re not comfortable with the complexities of the tax system.

Here are some of the features of Wealthsimple Tax:

- Easy to use: Wealthsimple Tax is designed to be user-friendly and easy to navigate. You don’t need to be a tax expert to use it, and it will guide you through the process step by step.

- Automated data import: Wealthsimple Tax can import your tax data automatically from a variety of sources, including your T4 slips, RRSP contributions, and investment income. This means you don’t need to enter all your data manually, which can save you time and reduce the risk of errors.

- Free for basic returns: Wealthsimple Tax is free to use for basic tax returns, which includes most situations for students and people with simple tax situations. If you have a more complex tax situation, such as self-employment income or rental properties, you may need to upgrade to a paid plan.

- Accurate calculations: Wealthsimple Tax uses the latest tax rules and algorithms to ensure that your tax calculations are accurate. This means you can be confident that your tax return is correct and you’re not missing any deductions or credits.

- CRA-certified: Wealthsimple Tax is certified by the Canada Revenue Agency (CRA), which means it meets their strict standards for accuracy and security. This means you can be confident that your tax return will be accepted by the CRA and that your personal information is protected.

Reminder: Everyone’s tax situation is different and you should always consult with a tax professional if you’re not sure about something when filing your taxes.

Wealthsimple Pros and Cons

Wealthsimple is a popular investing app that allows investors to buy the best Canadian dividend stocks and ETFs, commission-free. With its sleek design and user-friendly interface, Wealthsimple makes it easy for Canadians to invest their money and grow their wealth.

One of the key features of Wealthsimple is its managed investing tool, which uses sophisticated algorithms to build and manage a customized investment portfolio for each user. This means that you don’t need to have any prior investment knowledge to get started with Wealthsimple.

Another great reason to use Wealthsimple is its low fees. Unlike traditional investment firms that charge high management fees, Wealthsimple offers a simple, transparent fee structure that is easy to understand. You’ll pay a management fee of just 0.5% for accounts with balances under $100,000, and even less for larger accounts.

Wealthsimple also offers a wide range of investment options, including stocks, bonds, and exchange-traded funds (ETFs). This allows you to build a diversified portfolio that matches your investment goals and risk tolerance.

In terms of security, Wealthsimple takes the protection of your personal and financial information very seriously. The app uses bank-level security measures to keep your data safe, and your investments are held in custodial accounts with a third-party custodian.

Using the Wealthsimple app can help you save time and money while building a diversified investment portfolio that matches your goals and risk tolerance.

Check out some of the pros and cons of using Wealthsimple below:

|

Pros |

Cons |

| ✅ Low Fees | ❌ Not Enough Customization |

| ✅ User-Friendly Mobile App | ❌ Fewer Account Types |

| ✅ Diversified Portfolios | ❌ Limited Investment Options |

| ✅ Robo-advisor & Automatic Rebalancing | ❌ No Physical Branch Locations |

| ✅ Tax-Loss Harvesting | |

| ✅ Excellent Security |

Wealthsimple Advantages

- User-friendly app: Wealthsimple has a clean and intuitive interface that makes it easy for users to navigate and understand. Users don’t need any prior investment knowledge to get started and start buying stocks with Wealthsimple.

- Low fees: Wealthsimple offers a simple and transparent fee structure that is significantly lower than traditional investment firms. This means that you can keep more of your money invested and working for you.

- Diversification: Wealthsimple offers a wide range of investment options, including stocks, bonds, and ETFs. This allows you to build a diversified portfolio that matches your investment goals and risk tolerance.

- Robo-advisor: Wealthsimple Invest uses sophisticated algorithms to build and manage a customized investment portfolio for each user. This means that you don’t need to spend time researching and selecting individual investments.

- Automatic rebalancing: Wealthsimple automatically rebalances your portfolio to maintain your desired asset allocation. This ensures that your investments stay aligned with your long-term goals.

- Tax-loss harvesting: Wealthsimple offers tax-loss harvesting, which can help you minimize your tax bill by selling investments that have lost value and offsetting gains in other parts of your portfolio.

- Security: Wealthsimple uses bank-level security measures to keep your personal and financial information safe, and your investments are held in custodial accounts with a third-party custodian.

Wealthsimple Disadvantages

- Not enough customization: While Wealthsimple’s Invest creates a customized investment portfolio for each user, there is limited room for customization beyond that. Users cannot select individual stocks or funds outside of the pre-selected investment options.

- Lackluster customer support: Wealthsimple’s customer support is primarily online but our experience with the customer service agents was lackluster compared to other brokerages.

- Limited investment options: While Wealthsimple offers a wide range of investment options, some users may find that the available investment options are limited compared to what is offered by traditional investment firms.

- No physical branch locations: Wealthsimple is an online-only platform, which means that there are no physical branch locations where users can speak to an advisor in person. This may not be ideal for users who prefer face-to-face interactions with advisors.

Wealthsimple Web Trading Platform

Wealthsimple has one of the top investing apps in Canada, but members can also access their accounts with any web browser, using an easy-to-use web-based version of the trading platform.

The Wealthsimple web-based platform is a clean and user-friendly interface that is easy to navigate. The platform provides an overview of your account balances, investment holdings, and recent transactions. Users can also access detailed information about their investments, including performance history and fees.

One of the key features of the Wealthsimple web-based platform is the ability to trade Canadian and ETFs commission-free. This makes it an attractive option for investors who are looking to save on trading fees.

The platform also offers a range of investment options, including stocks, bonds, and ETFs, which allows you to build a diversified portfolio that matches your investment goals and risk tolerance. The platform’s robo-advisor service creates a personalized portfolio for each user, which takes into account your investment objectives, risk tolerance, and time horizon.

In terms of security, Wealthsimple uses bank-level security measures to protect your personal and financial information. Your investments are held in custodial accounts with a third-party custodian, which provides an additional layer of security.

One potential downside of the Wealthsimple web-based platform is that it does not offer as many advanced trading features as some other online brokers. However, the company has taken a step forward in that direction by offering investors the ability to trade options contracts at a fixed price.

Unlike other trading platforms, customer service does not seem to be a major priority at Wealthsimple. The platform’s customer support is primarily online and there is no phone support available.

Overall, the Wealthsimple web-based platform is a good choice for investors who are looking for a simple, user-friendly platform to manage their investments and trade commission-free.

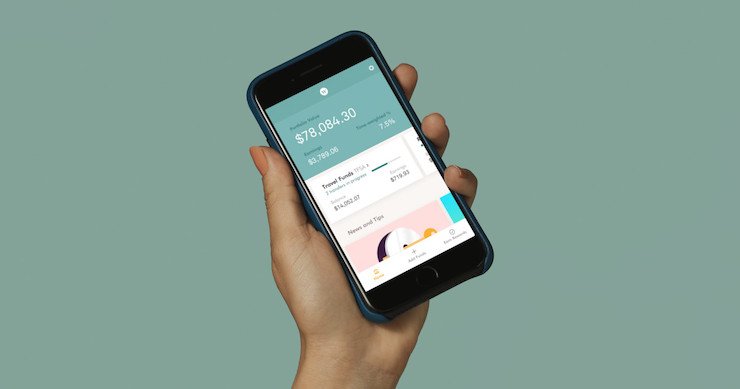

Wealthsimple App

Wealthsimple has a free app for iOS and Android devices that allows members to manage their investments and make trades on the go.

It’s easy to use and has some cool features like letting you automatically put money into your investment account every month, so you can save and invest at the same time.

One of the best things about the Wealthsimple app is that you can buy and sell stocks and ETFs without paying any fees. This means you get to keep more of your money instead of giving it away to a broker.

The app is also really secure, which means your information and money are safe. You can set up extra security measures like a password and fingerprint login to make sure nobody else can get into your account.

The app shows you how your investments are doing and how much money you have in your account. You can also see information about the companies you’re investing in, like how well they’re doing and how much money they’re making.

While the Wealthsimple app doesn’t have as many advanced features as some other investing apps, it’s a great choice for beginners who want to start investing and learn more about the stock market.

How To Sign Up To Wealthsimple

Like the best investing apps in Canada, Wealthsimple makes it easy to start buying the best Canadian stocks.

New members can open an account, add funds, and start buying the best Canadian stocks for free within a matter of minutes.

To sign up for an account with Wealthsimple follow our step-by-step guide below:

Step 1: Sign Up For A Wealthsimple Account

Go to the Wealthsimple website and click the “Get started” button.

From there, you will be asked to enter your email address and create a password. Once you’ve done that, you can begin the account setup process.

Step 2: Answer Questions About Your Risk Tolerance

Wealthsimple will ask you a series of questions to help determine your investment goals and risk tolerance.

This is important because it will help them recommend investment strategies that are appropriate for you.

Be sure to answer these questions honestly and to the best of your ability.

Step 3: Enter Your Personal Information

Next, you’ll be asked to provide your personal information, such as your name, date of birth, and contact information.

In order to invest with Wealthsimple, members must provide accurate account information.

You’ll also need to provide your Social Insurance Number (SIN) so Wealthsimple can verify your identity.

Step 4: Add Funds To Your Account

Before you can start trading, you’ll need to add funds to your Wealthsimple account.

You can do this by linking your bank account and transferring money directly into your Wealthsimple account.

Wealthsimple supports transfers from most Canadian banks, and there are no fees for transferring money in or out of your account.

Step 5: Start Buying The Best Canadian Stocks For Free

With your Wealthsimple account funded, you can start buying Canadian stocks for free.

Wealthsimple’s platform makes it easy to search for and buy stocks, as well as other investment products like ETFs and mutual funds.

You can use Wealthsimple’s tools and research to help you make informed investment decisions, and they also offer personalized investment advice if you need it.

And don’t forget to download the Wealthsimple app so you can easily manage your account on your phone.

Wealthsimple Fees

When choosing an investment account, it’s important to consider the fees, but it’s also important to consider other factors such as investment performance, user experience, and customer support.

Wealthsimple offers a range of accounts with different fees structures to suit different investment goals and risk tolerance levels. While there are some fees associated with using Wealthsimple’s services, their fees are generally lower than those charged by traditional investment firms.

Here’s a breakdown of the Wealthsimple fees for Invest, Trade, and Crypto accounts:

Wealthsimple Invest Fees

Wealthsimple Invest is an automatic trading account that offers a range of diversified portfolios tailored to your investment goals and risk tolerance level.

Here are the fees associated with Wealthsimple Invest:

Management Fees

Wealthsimple Invest charges a management fee of 0.5% for accounts with balances below $100,000 and 0.4% for accounts with balances above $100,000.

ETF Fees

The ETFs used in Wealthsimple Invest portfolios have an average management expense ratio (MER) of 0.2% to 0.25%. This fee is charged by the ETF provider and is included in the portfolio’s performance.

Wealthsimple Trade Fees

Wealthsimple Trade allows users to buy and sell the best Canadian stocks and ETFs commission-free.

However, there are other fees that users should be aware of:

Currency Conversion Fee

If you trade stocks or ETFs on foreign exchange, Wealthsimple Trade charges a currency conversion fee of 1.5% for CAD to USD and 0.5% for USD to CAD conversions.

Market Data Fees

Wealthsimple Trade offers real-time market data for free, but if you want access to Level 2 data, which provides more detailed information about the order book, you’ll need to pay a monthly fee of $3.

Note: It’s important to note that Wealthsimple also offers premium versions of their Invest and Trade accounts, called Wealthsimple Black and Wealthsimple Trade Pro, respectively. These premium versions come with additional features and benefits but also come with higher fees.

Wealthsimple Options Fees

Wealthsimple applies a fee per contract on all successful buy orders, which is automatically charged. The fee amount is based on your subscription status.

Here is a list of the Wealthsimple fees for options trading:

- Options contract fee : US$2

- Options early exercise fee : US$45

- Options exercise fee : US$20

- Options ORF fee : US$0.01815 per contract

- Options SEC fee : US$0.0000229 per gross dollar of sale, applied to sell transactions only

Wealthsimple Crypto Fees

Wealthsimple Crypto allows users to buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum. Here are the fees associated with Wealthsimple Crypto:

Crypto Trading Fees

Wealthsimple Crypto charges a fee of 1.5% for each cryptocurrency trade.

Network Fees

When you withdraw your cryptocurrency from Wealthsimple Crypto, you’ll need to pay a network fee, which covers the cost of processing the transaction on the blockchain.

Complete List of Wealthsimple Fees for Everyday Accounts

- Commission for listed US & Canadian securities : $0

- Account Opening : $0

- Account Closing : $0

- Deposits via Bank Transfer (EFT) : $0

- Withdrawals via Bank Transfer (EFT) : $0

- Electronic Statements & Trade Confirmations : $0

- Inactive account : $0

- Foreign Exchange Fee (CAD ⇆ USD) : WSII Corporate Exchange Rate x 1.5%

- Outgoing account transfers to another institution : $0

- Options contract fee : US$2

- Options early exercise fee : US$45

- Options exercise fee : US$20

- Options ORF fee : US$0.01815 per contract

- Options SEC fee : US$0.0000229 per gross dollar of sale, applied to sell transactions only

Is Wealthsimple Safe?

Yes, Wealthsimple is safe to use.

As a regulated online investment platform, Wealthsimple takes the security and safety of their users’ personal and financial information seriously.

While no investment platform can guarantee 100 percent safety, Wealthsimple has taken several measures to ensure their platform is secure and protected against unauthorized access or fraud

Here are some of the measures Wealthsimple takes to ensure its platform is secure:

- Regulation: Wealthsimple is regulated by the relevant financial authorities in the countries they operate in, including the Financial Conduct Authority (FCA) in the UK, the Investment Industry Regulatory Organization of Canada (IIROC) in Canada, and the Securities and Exchange Commission (SEC) in the United States. This means that Wealthsimple must meet strict regulatory standards to ensure they operate ethically and transparently.

- Encryption: Wealthsimple uses encryption technology to protect your data. This means that when you’re accessing Wealthsimple’s website or app, your information is transmitted securely using industry-standard SSL encryption. This ensures that your data is protected against unauthorized access by hackers or other malicious actors.

- Two-Factor Authentication: Wealthsimple offers an optional security feature called two-factor authentication (2FA) to add an extra layer of security to your account. With 2FA, you’ll need to enter a unique code generated by an app on your phone in addition to your username and password when you log in. This makes it much harder for someone to access your account even if they have your login information.

- Separation of User Funds: Wealthsimple keeps user funds in separate custodial accounts, which means that user funds are not mixed with Wealthsimple’s own funds. This provides an additional layer of protection in case of bankruptcy or other financial difficulties.

- Insurance: Wealthsimple is a member of the Canadian Investor Protection Fund (CIPF), which provides up to $1 million in coverage per account in case of insolvency. In the United States, Wealthsimple is a member of the Securities Investor Protection Corporation (SIPC), which provides up to $500,000 in coverage per account in case of insolvency.

Who Owns Weathsimple?

Wealthsimple is a privately-owned financial technology company that was co-founded by Michael Katchen, Brett Huneycutt, Rudy Adler, and other individuals who saw a need for a more accessible and transparent investment platform.

Since its founding, Wealthsimple has grown significantly and expanded its operations to several countries, including the United States and the United Kingdom. While Wealthsimple is privately owned, the company has received significant investment from several prominent investors, including Power Financial Corporation, a Canadian holding company that owns several financial services companies.

In May 2021, it was announced that the Canadian financial services company, Purpose Financial, would be acquiring Wealthsimple’s parent company, Shareholder Democracy Inc., in a deal that’s expected to close later in the year.

However, it’s worth noting that despite this acquisition, Wealthsimple will continue to operate as an independent entity under the leadership of its co-founder and CEO, Michael Katchen.

Wealthsimple Customer Service Options

Overall, Wealthsimple has a good reputation for customer service. They’ve received positive reviews from customers for their responsiveness, helpfulness, and transparency.

In fact, Wealthsimple has won several awards for their customer service, including being named one of the top 10 companies for customer service in Canada by the Canadian Customer Service Index in 2020.

One thing that sets Wealthsimple apart from other financial services companies is its commitment to transparency. The company has a detailed FAQ page that answers common questions about their fees, investment strategies, and more. Additionally, Wealthsimple provides regular updates to customers about their services and any changes that may impact their accounts.

Whether you prefer to reach out via email, live chat, or phone, Wealthsimple offers several options for getting the support you need.

Here are the different ways for customers to get in touch with the Wealthsimple support team:

- Email Support: You can reach out to Wealthsimple’s support team by sending an email to their customer support address. This is a good option if you have a non-urgent question or concern and don’t need an immediate response.

- Live Chat: Wealthsimple also offers a live chat option where you can chat with a customer support representative in real-time. This is a good option if you have a more urgent question or concern that requires immediate attention.

- Phone Support: If you prefer to speak to someone on the phone, you can call Wealthsimple’s customer support hotline. They have support teams available during regular business hours, and you can speak to a representative directly.

- Help Center: Wealthsimple has a comprehensive help center on their website that contains a wide range of articles and resources to help you with any questions or concerns you may have. This is a good option if you prefer to find answers to your questions on your own.

Wealthsimple Contact & Phone Number

Find the live chat hours, customer support email, and Wealthsimple phone number below.

Live Chat

Members can speak to the Client Success team via live chat seven days a week with extended hours during trading days.

Wealthsimple users can get answers from the Virtual Assistant 24/7 or reach the Client Success team during business hours.

Live chat is available Monday to Friday from 8 am to 8 pm ET and on the weekends from 9 am to 5 pm ET.

- Monday-Friday: 8am – 8pm (ET)

- Saturday & Sunday: 9am – 5pm (ET)

Wealthsimple can also be reached by email 24/7.

Members can email customer support and have their issues solved quickly even when live chat and phone support are closed.

Click here to submit a request to reach Wealthsimple by email.

Phone Number

Members can reach the Client Success team by phone at 1-855-255-9038.

- Monday-Friday: 8am – 8pm (ET)

- Saturday & Sunday: 9am – 5pm (ET)

Note: There is currently no phone support for Wealthsimple Tax customers.

Wealthsimple Referral Code

Wealthsimple allows new members to receive certain benefits using a referral code upon signing up.

The investing app has a number of different rewards for new members to cash in on.

Users can receive free stocks, cash bonuses, free transfer fees and more depending on the referral code.

Is Wealthsimple The Best Investing Platform In Canada?

Overall, the Wealthsimple app is a powerful and convenient tool for Canadian investors that offers a wide range of features for traders of all experience levels.

New users can sign up to Wealthsimple and receive up to $50 in free trades to use on the best Canadian stocks.

Not only is Wealthsimple one of the best investing apps in Canada but it is a valuable resource for anyone looking to manage their investments on the go.